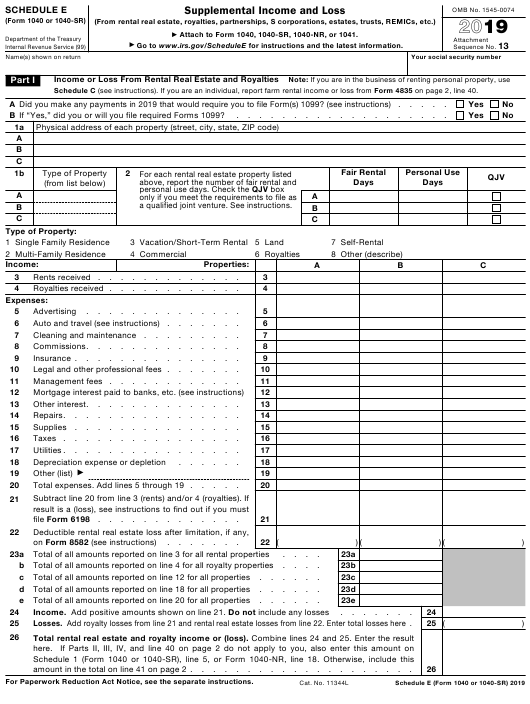

1040-SR includes a chart listing the standard deduction to make it easier to calculate it. Distributions from qualified retirement plans and others.Įligible taxpayers may use this form when they want the standard deduction or the itemized one.

You need to send this form in case if you have the following additional sources of income: What I need the printable 1040-SR form for? One can download the 1040-SR blank PDF form for free from the PDFLiner and print it later, or fill it out online. State tax formsĭownload your state's tax forms and instructions for free.This document is used for the adults (65 years old or higher) to file their taxes through the IRS system to report other sources of income. Use this IRS page to find your state and the address to mail your tax forms.

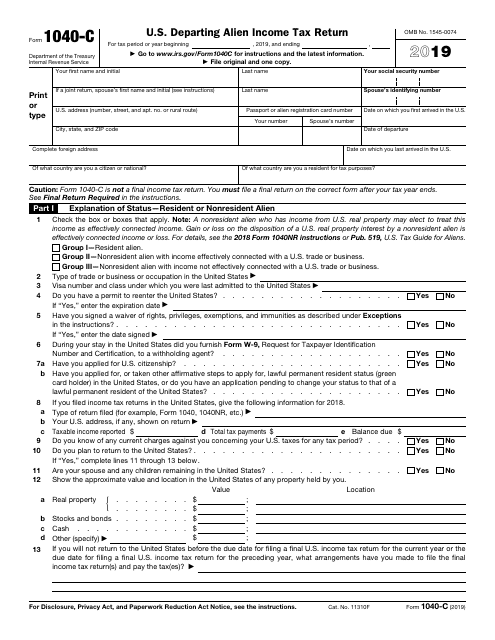

Where you mail your federal income tax forms depends on your state and the forms you are using. The IRS provides many forms and publications in accessible formats for current and prior tax years. And they are created to work well with assistive technologies like software that reads computer or smartphone screens. Accessible federal tax formsĪccessible forms are designed to be easier to read or understand for people with different needs. The form is optional and uses the same schedules, instructions, and attachments as the regular 1040. It has bigger print, less shading, and features like a standard deduction chart. It is an easier-to-read version of the 1040 form.

The IRS has released a new tax filing form for people 65 and older. You can also find printed versions of many forms, instructions, and publications in your community for free at: Get the current filing year’s forms, instructions, and publications for free from the IRS.

0 kommentar(er)

0 kommentar(er)